Electric Charging Stations: Data Analysis (Pt. 2)

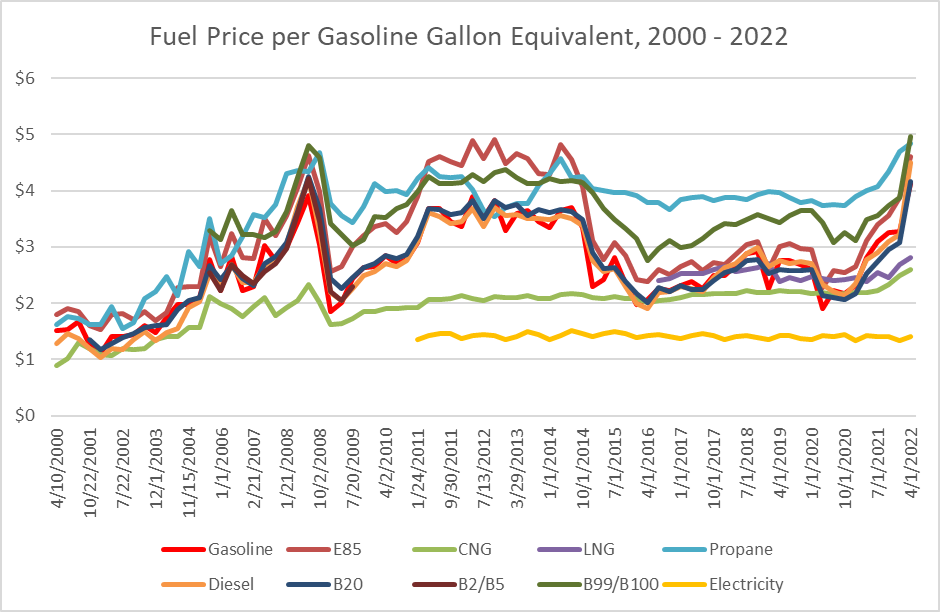

Fueling a car with an internal combustion engine has been costly in the last several months. Plotting the price per gallon of gas equivalent for various fuel sources, we can see that electricity appears to be the most affordable option.

How fast is EV Charging Infrastructure Growing?

Continuing from the first part of assessing the state of electric charging stations, I want to develop a sense of how far away we are from a steady state infrastructure that can handle mass adoption of electrified vehicles.

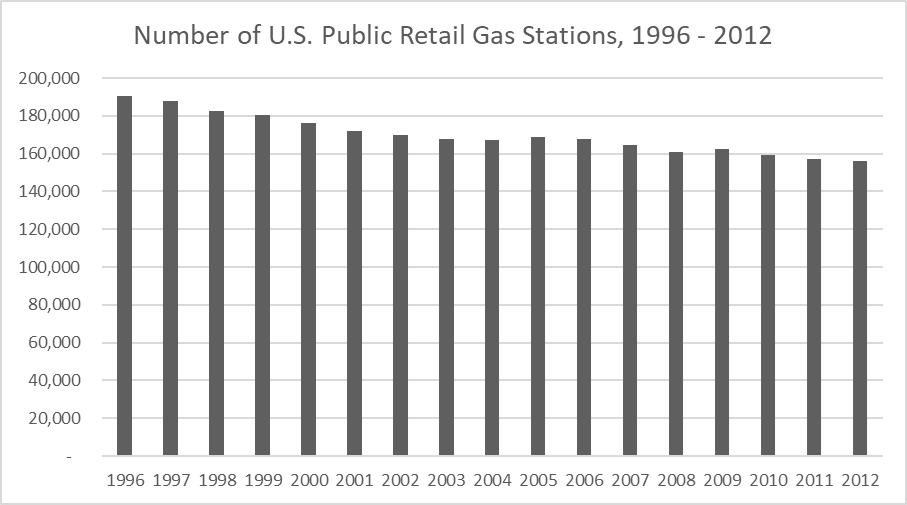

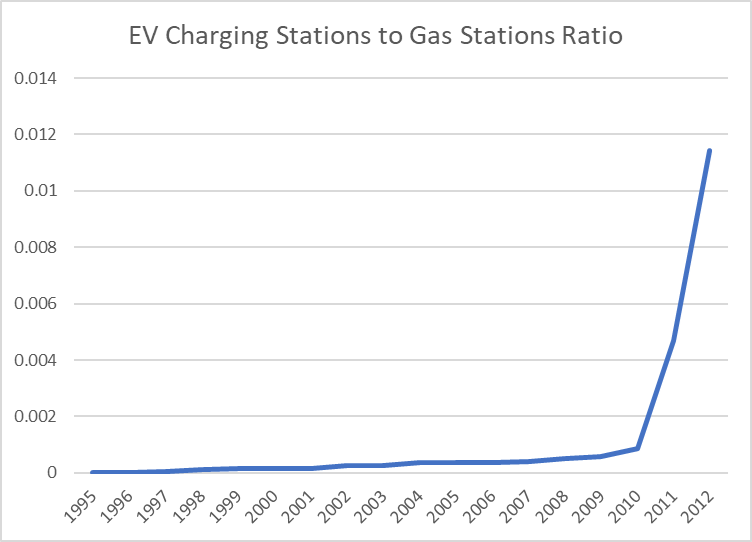

To do so, I was curious to know how many gas stations that exist within the U.S. today to see what a mature, steady state may happen to look like. From the Alternative Fuel Data Center, we see a steady decline of public, retail gas stations, with a total of 156,065 stations in 2012 in the U.S.

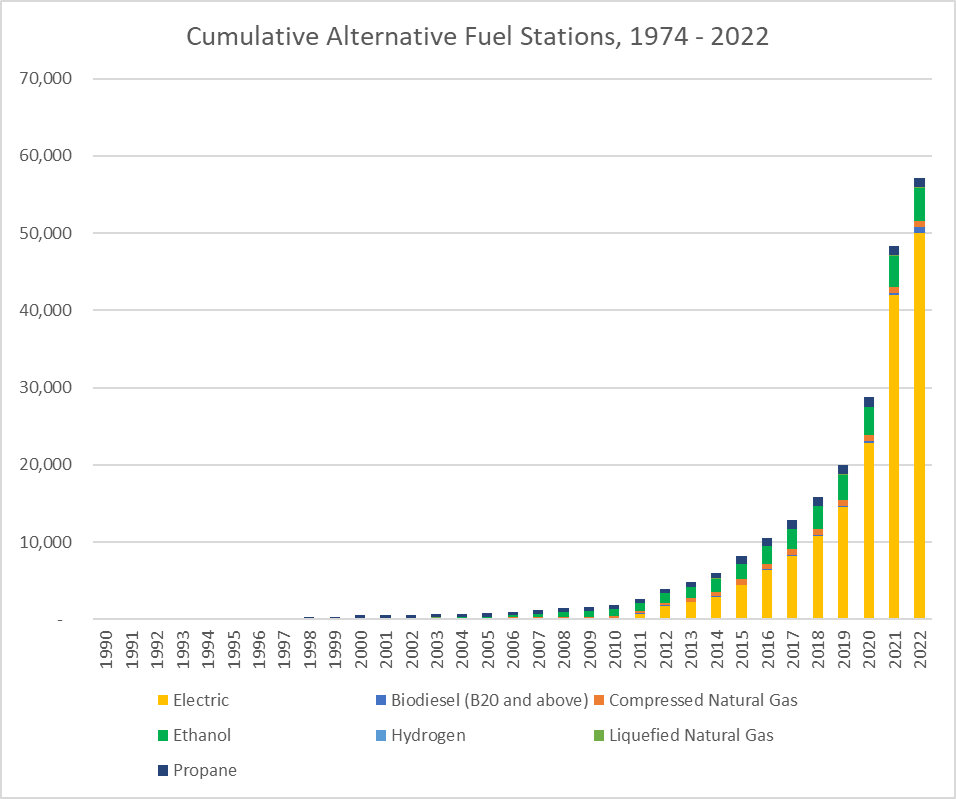

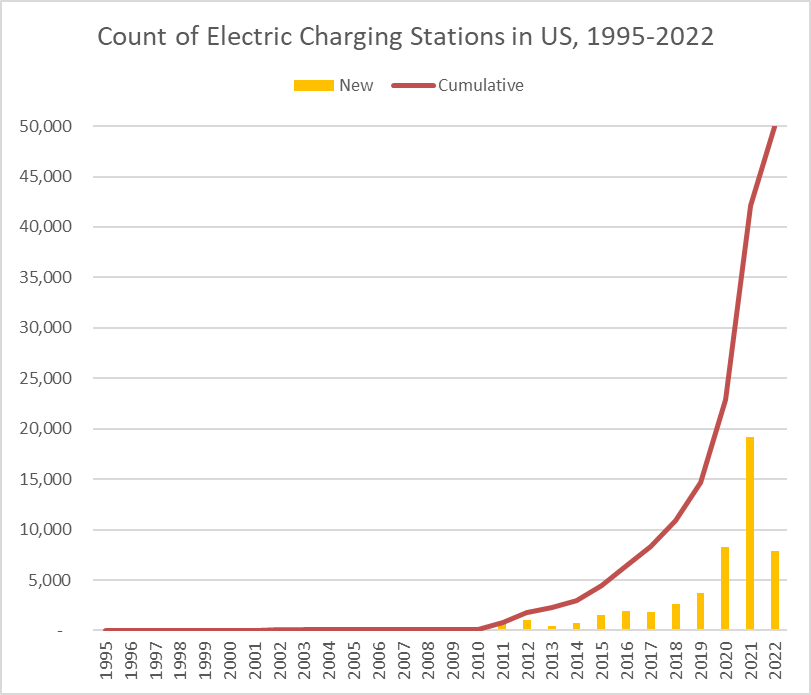

Next, I want to understand how fast alternative fuels, particularly electric, are growing within the country:

Electric charging stations compose the fastest growing segment within the last 5 years (43% CAGR).

Comparing the number of EV charging stations to the number of gas stations, we can see that we are still in the early innings of rolling out the EV charging infrastructure as of 2012:

Who is leading the charge in rolling out the infrastructure?

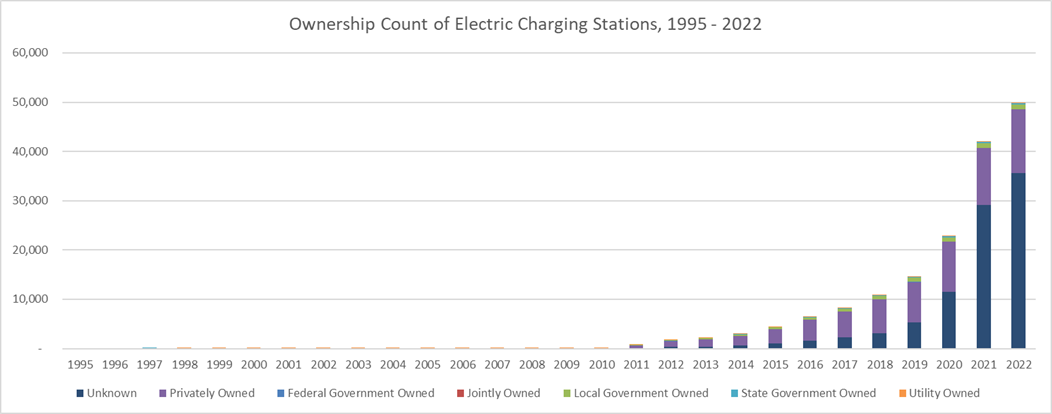

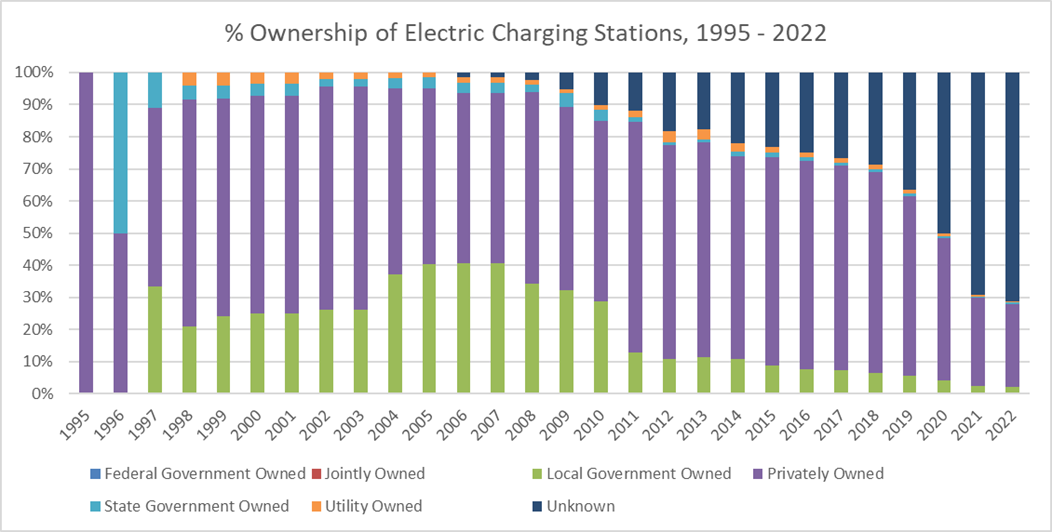

When assessing the maturity of the EV infrastructure, I was curious to dig into what type of players are contributing to the development of EV charging stations. As such, I would figure out what type of entity owns the charging station and the network to which the station belongs.

Looking at the above two graphs, we can see that private entities own most of the EV charging stations within the past decade. Interestingly, the dataset shows a rapid growth of charging stations with an unknown entity as an owner. In the mid-2000s, the local government also owns ~40% of charging stations at its peak.

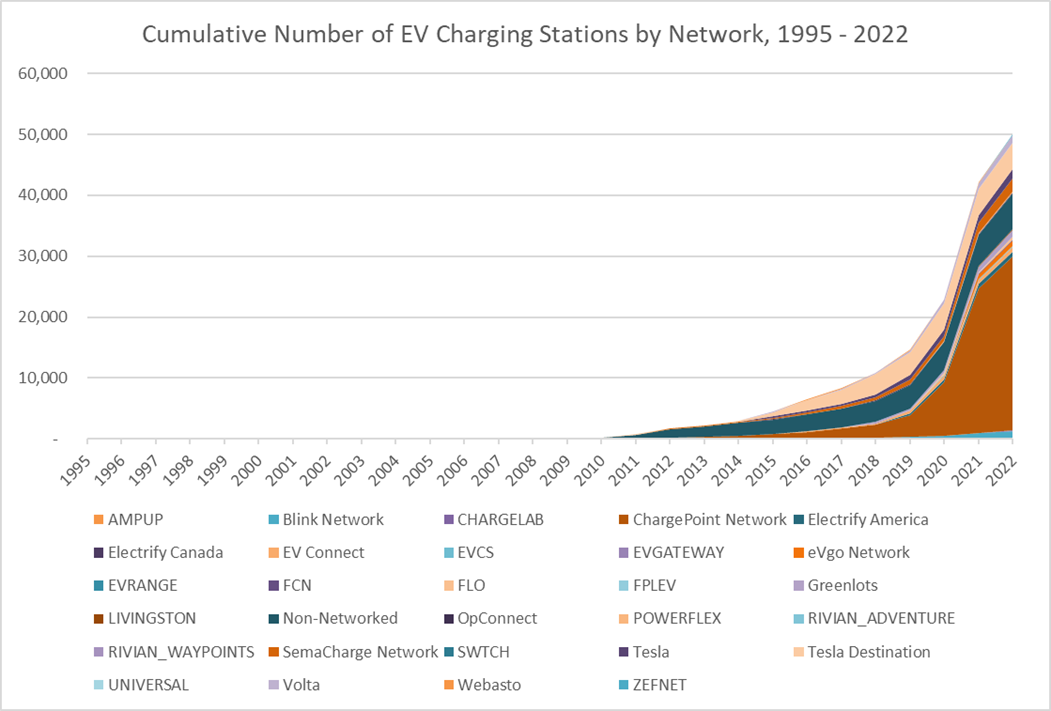

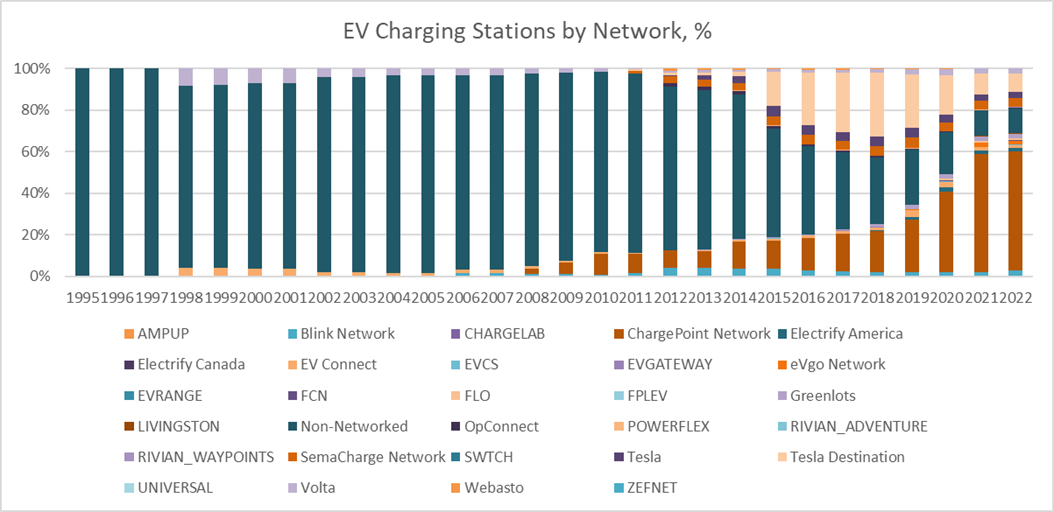

By segmenting the data base on network, we can see that within the last 10 years, ChargePoint and Tesla compose the highest percentage of charging infrastructure. As of today, ChargePoint contributes 57.3% of the publicly available EV charging stations in the U.S. while Tesla contributes 11.6%.

How will EV charging infrastructure scale?

Assessing the levers to scaling EV charging infrastructure, I noticed that 1) the electric grid and 2) underground construction methods may impede the rollout of EV charging stations. Building connections to the grid is slow and costly and buried infrastructure is unrecoverable and costly to expand. As such, deploying above-ground solutions that leverage today's existing infrastructure (whether that is the home, commercial buildings, existing stations, etc.) can be one strategy to scale the country's EV infrastructure.